- Call for a Free Consultation, Near You. Hablamos Espanol

- Call for a Free Consultation, Near You. Hablamos Espanol

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout

- Long Island and New York, Since 1993.

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout Long Island and New York, Since 1993.

Bankruptcy Lawyer in Long Island, NY

Expert bankruptcy assistance for financial relief

Receive personalized guidance to eliminate debts, protect assets, and regain financial control. We are here to help you get a fresh start.

Hear from Our Clients

Valuable but FREE initial legal consultations at our CONVENIENT Long Island and New York City law office locations. Click below for directions:

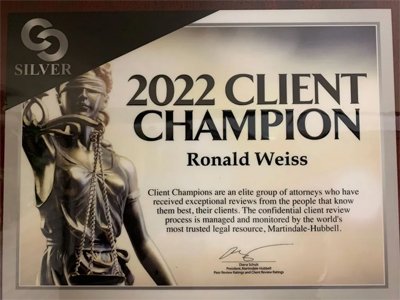

We Deliver Results To Our Clients, And It Shows

100% Recommend

We have helped over 10,000 Long Island and New York City residents and businesses overcome debt challenges since 1993.

Bankruptcy Law in Long Island

Experienced bankruptcy lawyers offering strategic financial solutions in Long Island.

Bankruptcy provides individuals and businesses with a legal means to address overwhelming debt and move forward toward a more secure financial future. At Ronald D. Weiss, PC, we specialize in navigating the complexities of bankruptcy law. Whether you need to eliminate unsecured debts or reorganize your financial obligations, we’re here to guide you through every stage of the process.

Our attorneys have years of experience and a deep understanding of the bankruptcy system. We work closely with clients to explain the different bankruptcy chapters available, such as Chapter 7, Chapter 11, and Chapter 13. Each option serves distinct needs, and we’ll help you choose the one that’s right for your situation, ensuring that you achieve the maximum benefit and protection from creditors.

Benefits of Bankruptcy Filing

How bankruptcy can give you a fresh financial start

Halt creditor harassment immediately with an automatic stay.

Potentially discharge large amounts of unsecured debt like medical bills and credit cards.

Develop manageable repayment plans for debts that can’t be discharged.

Protect your home from foreclosure or car from repossession.

Receive expert guidance through complex legal processes.

Build a stronger financial future by eliminating insurmountable debts.

What Is Bankruptcy?

Understand the purpose and process of filing for bankruptcy

Bankruptcy is designed to provide financial relief by discharging or reorganizing debts. When you file for bankruptcy, you gain legal protection from creditors and the ability to resolve financial struggles that have become too difficult to overcome. This legal process allows individuals and businesses to either eliminate unsecured debts or create a payment plan that suits their financial capacity.

In addition to providing debt relief, bankruptcy is also structured to ensure fairness to creditors. The process helps balance the debtor’s need for relief with the creditor’s right to seek repayment. At Ronald D. Weiss, PC, we’ll work with you to determine if bankruptcy is the right solution and which chapter best meets your specific needs. Our team provides clarity and expert advice throughout the process to ensure you make the best decision for your future.

Bankruptcy

Chapter 7 vs Chapter 13 Bankruptcy

Choosing the right bankruptcy chapter for your needs

Chapter 7 and Chapter 13 bankruptcy are the two most common forms of personal bankruptcy, but they serve different purposes. Chapter 7 allows for the complete discharge of qualifying debts, meaning they are eliminated without the need for repayment. This chapter is often ideal for individuals with significant unsecured debt and limited assets to protect. However, not everyone qualifies for Chapter 7, as it is subject to a means test based on income and expenses.

On the other hand, Chapter 13 bankruptcy is designed for individuals with a steady income who wish to reorganize their debts into a manageable repayment plan. Over three to five years, the debtor makes monthly payments to the court-appointed trustee, who then distributes the funds to creditors. Chapter 13 can be especially helpful for those looking to protect their home from foreclosure or catch up on missed car payments. At Ronald D. Weiss, PC, we will evaluate your financial situation and recommend the best chapter for your needs, ensuring you understand the pros and cons of each option.

Bankruptcy Discharge

Start Your Path to Financial Freedom

Take control of your finances today

Filing for bankruptcy is a powerful tool that can help you regain control of your financial future. With the right legal guidance, bankruptcy allows you to eliminate or reorganize debt, protect assets, and start fresh. At Ronald D. Weiss, PC, we’re committed to providing you with the support and expertise needed to make informed decisions and achieve the best possible outcome.

Don’t let debt continue to overwhelm you. Our experienced bankruptcy lawyers are here to guide you through the process, providing personalized solutions that match your unique financial situation. Contact us today for a free consultation and take the first step toward financial freedom.

Frequently Asked Questions

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 generally involves liquidating non-exempt assets to pay debts and is quicker, while Chapter 13 creates a 3-5 year repayment plan using your income to catch up on debts.

Will filing for bankruptcy eliminate all of my debts completely?

Bankruptcy typically discharges unsecured debts like credit cards and medical bills, but usually not student loans, recent taxes, or domestic support obligations like alimony or child support.

How much does it typically cost to file for bankruptcy on Long Island?

Costs vary based on the chapter filed and case complexity, including court filing fees (around $338 for Chapter 7 and $313 for Chapter 13) and attorney fees, discussed in your consultation.

Can I keep my house and car if I file with a bankruptcy law firm?

Often, yes. Exemptions protect equity in homes and vehicles. A Chapter 13 bankruptcy lawyer can also help structure plans to catch up on payments and retain these assets.

How long does the bankruptcy process usually take from start to finish?

A Chapter 7 case typically concludes in 4-6 months. In contrast, a Chapter 13 repayment plan lasts for 3 to 5 years before debts are finally discharged.

What happens immediately after my bankruptcy lawyer files my case?

An “automatic stay” goes into effect, instantly stopping most creditors from contacting you, garnishing wages, repossessing property, or pursuing lawsuits while the case proceeds.

Areas We Serve-

- Bath Beach

- Bay Ridge

- Bedford-Stuyvesant

- Bensonhurst

- Bergen Beach

- Borough Park

- Brighton Beach

- Brooklyn

- Brooklyn Heights

- Brooklyn Navy Yard

- Brownsville

- Bushwick

- Canarsie

- Carroll Gardens

- Clinton Hill

- Cobble Hill

- Coney Island

- Crown Heights

- Cypress Hill

- Dumbo

- Dyker Heights

- East Flatbush

- East Williamsburg

- Flatbush

- Flatlands

- Fort Greene

- Fort Hamilton

- Gerritsen Beach

- Gowanus

- Gravesend

- Greenpoint

- Greenwood Heights

- Kensington

- Manhattan Beach

- Mapleton

- Midwood

- Mill Basin

- Park Slope

- Prospect Heights

- Prospect Lefferts Gardens

- Red Hook

- Sea Gate

- Sheepshead Bay

- South Slope

- Starrett City

- Sunset Park

- Vinegar Hill

- Williamsburg

- Windsor Terrace

- Baldwin

- Bellmore

- Bethpage

- East Massapequa

- East Meadow

- East Rockaway

- Elmont

- Floral Park

- Franklin Square

- Freeport

- Garden City

- Glen Cove

- Great Neck

- Hempstead

- Hicksville

- Inwood

- Jericho

- Levittown

- Long Beach

- Lynbrook

- Massapequa

- Massapequa Park

- Merrick

- Mineola

- New Cassel

- New Hyde Park

- North Bellmore

- North Hempstead

- North Massapequa

- North Merrick

- North Valley Stream

- North Wantagh

- Oceanside

- Oyster Bay

- Plainview

- Port Washington

- Rockville Centre

- Roosevelt

- Salisbury

- Seaford

- South Farmingdale

- Syosset

- Uniondale

- Valley Stream

- Wantagh

- West Hempstead

- Westbury

- Woodbury

- Woodmere

- Astoria

- Astoria Heights

- Auburndale

- Bay Terrace

- Bayswater

- Beechhurst

- Belle Harbor

- Breezy Point

- Briarwood

- Broad Channel

- Brooklyn Manor

- Cambria Heights

- Cedar Manor

- College Point

- Ditmars Steinway

- Far Rockaway

- Floral Park

- Fort Tilden

- Fresh Meadows

- Glen Oaks

- Hollis

- Hollis Hills

- Holliswood

- Howard Beach

- Jamaica Hills

- Laurelton

- Little Neck

- Long Island City

- Malba

- Maspeth

- Meadowmere Park

- Murray Hill

- Neponsit

- Ozone Park

- Parsons Beach

- Pomonok

- Queens

- Queens Village

- Rockaway Park

- Rosedale

- Roxbury

- Seaside

- Springfield Gardens

- Sunnyside

- Whitestone

- Babylon

- Bay Shore

- Brentwood

- Brookhaven

- Centereach

- Central Islip

- Commack

- Copiague

- Coram

- Deer Park

- Dix Hills

- East Hampton

- East Islip

- East Northport

- East Patchogue

- Farmingville

- Greenlawn

- Hampton Bays

- Hauppauge

- Holbrook

- Holtsville

- Huntington

- Huntington Station

- Islip

- Kings Park

- Lake Ronkonkoma

- Lindenhurst

- Manorville

- Mastic

- Mastic Beach

- Medford

- Melville

- Nesconset

- North Amityville

- North Babylon

- North Bay Shore

- Ridge

- Riverhead

- Rocky Point

- Ronkonkoma

- Sayville

- Selden

- Shirley

- Smithtown

- Southampton

- Southold

- St. James

- West Babylon

- West Islip

- Wyandanch

- NYC

- Manhattan

- Washington Heights

- Inwood

- Alphabet City

- Battery Park City

- Central Park

- Chelsea

- Chinatown

- Civic Center

- Downtown New York

- East Harlem

- East New York

- East Village

- Financial District

- Flatiron District

- Fort George

- Garment District

- Gramercy Park

- Greenwich Village

- Harlem

- Hudson Square

- Kips Bay

- Little Italy

- Lower East Side

- Marble Hill

- Midtown

- Morningside Heights

- Murray Hill

- NoHo

- Nolita

- Roosevelt Island

- home

- About

- Scholarship

- services

- Bankruptcy Lawyer

- Foreclosure Lawyer

- Negotiations & Settlements

- Credit Card Negotiations and Settlements

- Retention Options for Distressed Real Estate

- Tax Debt Negotiations and Settlements

- Student Loan Debt Negotiations

- Business Debt Negotiations and Settlements

- Medical Debt Negotiations

- Credit Repair

- Third-Party Short Sales and Voluntary Sales

- Deed in Lieu Agreements

- Cash for Keys Agreements

- Credit Card Reductions – Debt Reduction Lawyer for Credit Cards

- Consent to Judgment of Foreclosure and Sale Agreements

- Landlord-Tenant Negotiations and Settlements

- Mortgage Loan Modifications

- Credit Card Solutions

- Debtor litigation defense

- landlord Tenant Solutions

- Distressed Real Estate Solutions

- Student Loan Solutions

- Tax Debt Solutions

- Locations

- Hours

- Careers

- testimonials

- Blog

- faq’s

- contact