- Call for a Free Consultation, Near You. Hablamos Espanol

- Call for a Free Consultation, Near You. Hablamos Espanol

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout

- Long Island and New York, Since 1993.

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout Long Island and New York, Since 1993.

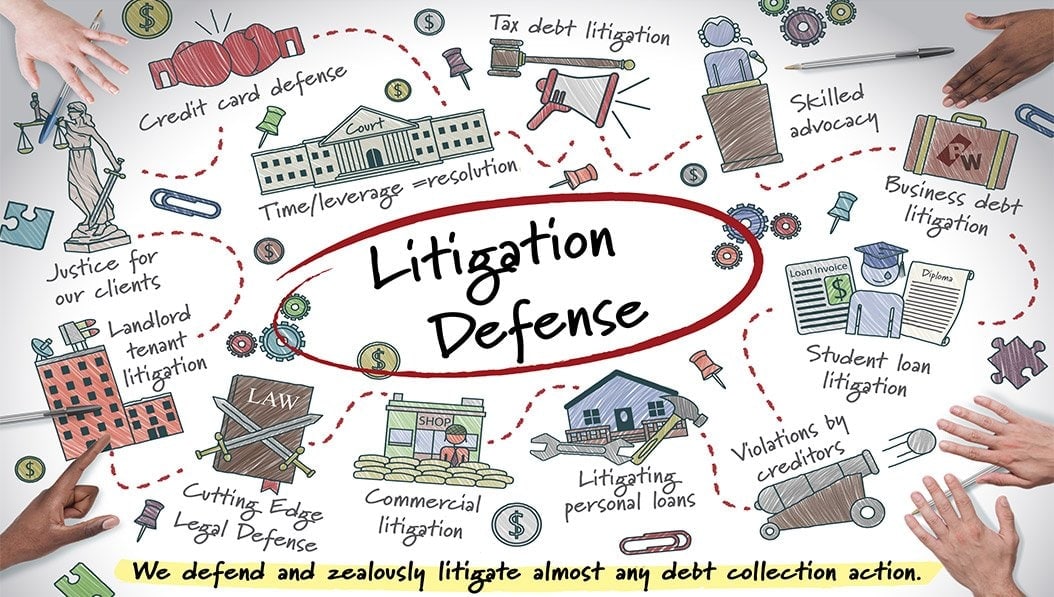

Debtor Litigation Defense Long Island, NY

Responding to Creditor Lawsuits

Are you facing a lawsuit from a creditor? Get knowledgeable legal help for debtor litigation defense on Long Island from Ronald D. Weiss, PC.

Focused Practice Area

Our attorneys concentrate on debt-related matters, including debtor litigation defense, handling numerous cases across Long Island courts.

Personalized Strategy

We analyze the specifics of your situation to develop a defense approach suited to your circumstances and objectives.

Local Knowledge

We are familiar with the local court rules and procedures relevant to debtor litigation cases in Nassau and Suffolk Counties.

Clear Communication

We keep you informed about your case progress and explain the legal options available throughout the debtor litigation defense process.

Debtor Lawsuit Defense Long Island, NY

Navigating Debt Collection Lawsuits with Assistance on Long Island

Receiving notice of a lawsuit filed by a creditor can be a distressing experience. It initiates a legal process that requires careful attention and timely responses. At Ronald D. Weiss PC, we offer debtor litigation defense services for individuals and businesses across Long Island. Our attorneys know the complexities of debt collection lawsuits and work to protect your rights throughout the proceedings. We aim to develop strategies that address the legal challenges and lessen the burden associated with these creditor actions.

Seeking legal assistance early is often beneficial when dealing with a lawsuit.

Our firm focuses on offering guidance grounded in the specifics of your case. We can:

- Analyze the Creditor’s Claims

- Review Relevant Documentation

- Explore Potential Defenses

- Discuss Resolution Options

With our help in debtor litigation defense, you can confront the lawsuit with informed support, aiming for a resolution that aligns with your financial circumstances.

Our Extensive Legal Services Long Island, NY

Debtor Litigation Solutions

Benefits of Legal Defense Creditor Lawsuits Long Island, NY

Working Towards Constructive Resolutions

Engaging our firm for debtor litigation defense can offer several advantages as you navigate the legal process.

Receive clarification of your legal rights and options when facing a lawsuit from a creditor or debt collector.

Obtain assistance in navigating the court system and responding appropriately to legal documents like summonses and complaints.

Explore potential defenses that may challenge the validity of the debt or the creditor's right to sue.

Work toward protecting your assets from potential judgments, liens, or wage garnishments resulting from the lawsuit.

Benefit from having a legal representative handle communications and negotiations with opposing counsel or creditors.

Reduce the personal stress often associated with facing legal action by having knowledgeable support guide you.

Share details

Call us or get a free online consultation to help us identify your needs.

We'll follow up

If you requested an online consultation, you can expect a callback within 24-48 hours of your request.

The floor is yours

Connect with an expert and share all project specifics.

Planning

Like what you hear? We'll provide next steps and expert guidance.

Understanding Debtor Litigation Defense Process Long Island, NY

The Importance of Responding to a Lawsuit

Debtor litigation occurs when a creditor files a lawsuit against an individual or business to recover an alleged outstanding debt. Ignoring such a lawsuit can lead to a default judgment against you, potentially allowing the creditor to pursue collection actions like freezing bank accounts or garnishing wages. Therefore, responding appropriately is essential. Engaging an attorney for debtor litigation defense supplies you with representation to formally answer the lawsuit and assert any available defenses.

At Ronald D Weiss PC, we assist clients on Long Island in understanding the claims made against them and the potential consequences. We review the case details, including the debt amount, the creditor’s standing to sue, and compliance with collection laws. Crafting a solid response and defense strategy requires analyzing these elements carefully. Our role in debtor litigation defense involves guiding you through this complex process and advocating for your interests within the legal framework.

Strategies in Debtor Litigation Defense Long Island, NY

Developing Your Defense Approach

Several potential strategies exist within debtor litigation defense, and the most suitable approach depends entirely on the facts of your case. Firstly, we examine procedural defenses, such as improper service of the lawsuit or filing in the wrong court. Secondly, we scrutinize the debt itself—was the amount calculated correctly? Does the creditor have sufficient proof of ownership? Has the statute of limitations expired? Raising these issues can sometimes lead to dismissal.

Negotiation is often a part of the debtor litigation defense process. We may be able to negotiate a settlement with the creditor for a reduced amount or arrange a structured payment plan, potentially avoiding a judgment. In some situations, exploring options like bankruptcy might be a consideration if the debt burden is overwhelming. Ronald D. Weiss, PC, helps Long Island clients evaluate all available paths and implement the chosen strategy effectively.

Hear from Our Clients

Steps in Our Legal Defense Service

What exactly is debtor litigation defense?

Debtor litigation defense involves the legal representation provided to individuals or businesses facing lawsuits from creditors seeking to collect debts. It aims to protect your rights and interests.

How can Ronald D Weiss PC help if I'm sued for debt?

Our attorneys can analyze the lawsuit, advise you on your options, prepare and file responses, represent you in court, and negotiate with creditors on your behalf as part of your defense.

What should I do immediately after getting a lawsuit notice?

Do not ignore it. Contact a law firm experienced in debtor litigation defense promptly to understand the deadlines and discuss how to respond appropriately to protect your rights.

What defenses might be available in a debt lawsuit?

Potential defenses can include expired statute of limitations, mistaken identity, incorrect debt amount, lack of creditor standing, or violations of debt collection laws, depending on case facts.

How much does hiring an attorney for debtor litigation defense cost?

Legal fees vary based on case complexity. We offer clear explanations of our fee structure during the initial consultation so you understand the potential costs involved upfront.

What are possible outcomes of a debtor litigation defense case?

Outcomes can range from case dismissal or withdrawal to negotiated settlements for a reduced amount, payment plans, or, if no defense prevails, a judgment against the debtor.

Consultation

We begin by discussing the details of the lawsuit you received and evaluating the initial facts of your situation.

Analysis

Next, our attorneys analyze the case specifics and develop a personalized legal strategy for your debtor litigation defense.

Representation

Finally, we represent you in court filings, negotiations, and hearings, actively working towards resolving the debtor litigation matter.

- home

- About

- Scholarship

- services

- Bankruptcy Lawyer

- Foreclosure Lawyer

- Negotiations & Settlements

- Credit Card Negotiations and Settlements

- Retention Options for Distressed Real Estate

- Tax Debt Negotiations and Settlements

- Student Loan Debt Negotiations

- Business Debt Negotiations and Settlements

- Medical Debt Negotiations

- Credit Repair

- Third-Party Short Sales and Voluntary Sales

- Deed in Lieu Agreements

- Cash for Keys Agreements

- Credit Card Reductions – Debt Reduction Lawyer for Credit Cards

- Consent to Judgment of Foreclosure and Sale Agreements

- Landlord-Tenant Negotiations and Settlements

- Mortgage Loan Modifications

- Credit Card Solutions

- Debtor litigation defense

- landlord Tenant Solutions

- Distressed Real Estate Solutions

- Student Loan Solutions

- Tax Debt Solutions

- Locations

- Hours

- Careers

- testimonials

- Blog

- faq’s

- contact