- Call for a Free Consultation, Near You. Hablamos Espanol

- Call for a Free Consultation, Near You. Hablamos Espanol

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout

- Long Island and New York, Since 1993.

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout Long Island and New York, Since 1993.

Real Estate Below Value Long Island, NY

Guiding Your Transactions in Unprecedented Property Markets

Considering a purchase or sale of distressed real estate on Long Island? Ronald D. Weiss, PC, involves the vital legal support for these transactions.

Transaction Control

Our firm parlays know-how in the direction of the complexities in distressed real estate properties.

Investment Protection

We take into account financial stakes in real estate transactions.

Strategic Deal

We craft defined strategies for navigating distressed property acquisitions and sales.

Client Focused

At Ronald D. Weiss, PC, your specific goals are calculated in every distressed real estate endeavor.

Real Estate Transaction Lawyer Long Island, NY

Prudent Transactions in Distressed Real Estate on Long Island

Opportunities and pitfalls characterize the distressed real estate market on Long Island. For confident navigation through these transactions, Ronald D. Weiss, PC, offers necessary legal counsel. We guide buyers searching for undervalued distressed properties and sellers managing tough market conditions, working to protect your stake and foster an easy process. Recognizing the distinct issues faced by buyers in distressed real estate situations is the starting point.

A real estate transaction lawyer with experience in distressed properties is essential. Transactions often involve intricate negotiations, title issues, and potential liens or encumbrances that require careful examination. Using an attorney for real estate transactions, especially those involving distressed properties, offers a layer of security and helps lower risks.

Benefits of Legal Guidance for Distressed Real Estate, Long Island, NY

Informational Support for Your Distressed Property Ventures

Choosing Ronald D. Weiss, PC, for your distressed real estate dealings offers advantages in these specialized transactions.

Acquire a through understanding of the specific legal considerations involved in distressed property purchases.

Benefit from thorough due diligence to identify and address potential risks associated with distressed real estate properties.

Achieve gratifying terms through negotiation of purchase or sale agreements.

Make sure all legal documents are accurately prepared and reviewed, protecting your transaction.

Reduce the stress and uncertainty often associated with buying or selling distressed properties.

Work towards a secure and legally sound conclusion to your distressed real estate transaction.

Share details

Call us or get a free online consultation to help us identify your needs.

We'll follow up

If you requested an online consultation, you can expect a callback within 24-48 hours of your request.

The floor is yours

Connect with an expert and share all project specifics.

Planning

Like what you hear? We'll provide next steps and expert guidance.

Understanding Distressed Real Estate Properties Long Island, NY

Navigating the Unique Landscape of Distressed Property Transactions

Distressed real estate properties are typically indicative of foreclosure, short sale situations, or properties with significant disrepair. Transactions involving these properties often deviate from standard real estate deals and necessitates a heightened level of scrutiny. Particular concerns for buyers of real estate in these circumstances can include undisclosed liens, title defects, and the condition of the property itself. A real estate transaction lawyer experienced in distressed assets can supply unlimited assistance in identifying and addressing these potential challenges.

Ronald D. Weiss, PC, offers the legal oversight required for these transactions. We conduct thorough title searches, review adeviatesant documentation, and advise our clients on risks and liabilities associated with the property. We aim to make sure that you are fully aware of the property’s status and can make decisions regarding your investment. Using an attorney for real estate transactions involving distressed properties is a measure of protecting your financial interests.

Role of a Real Estate Transaction Lawyer Long Island, NY

Why Legal Counsel is Essential for Distressed Property Deals

Having a competent real estate transaction lawyer is essential when dealing with distressed real estate. These transactions often involve accelerated timelines and complex legal procedures that require careful navigation.

Your attorney can offer essential services such as:

- Reviewing and Drafting Purchase Agreements

- Negotiating Terms

- Promoting Clear Title

- Guiding You Through The Closing Process

Using an attorney for real estate transactions involving distressed properties helps to mitigate risks and protect your rights.

At Ronald D. Weiss, PC, we understand the particular concerns of buyers of real estate and sellers in distressed situations. Our experience allows us to anticipate hurdles and address them, making for a smoother transaction. We are committed to offering our Long Island clients the legal representation needed to manage distressed real estate properties.

Hear from Our Clients

FAQ

What defines a property as "distressed real estate"?

Distressed real estate typically includes properties facing foreclosure, short sales, or those in significant disrepair or financial hardship.

What are some particular concerns for buyers of real estate in distressed situations?

Buyers should be particularly aware of potential title issues, undisclosed liens, and the property’s physical condition, requiring thorough due diligence.

Why is using an attorney for real estate transactions involving distressed properties important?

An attorney can help navigate the complex legal aspects, identify potential risks, and assure your rights are protected throughout the process.

What role does a real estate transaction lawyer play in a distressed property purchase?

A lawyer reviews contracts, conducts due diligence, negotiates terms, and makes sure a clear title transfer during the closing.

Can a seller also benefit from using an attorney for distressed real estate?

Yes, an attorney can help sellers navigate complex sales agreements, address potential liabilities, and confirm a legally sound transaction.

What are some key steps in the process of buying distressed real estate?

Key steps include securing financing, conducting thorough inspections, reviewing the title, and working closely with your real estate transaction lawyer.

Initial Consultation

We begin by discussing your specific distressed real estate goals and reviewing any relevant documentation.

Due Diligence

We conduct thorough due diligence, including title review and an assessment of risks associated with the property.

Transaction Management

From negotiation to closing, we handle all legal aspects of the transaction, protecting your interests.

- home

- About

- Scholarship

- services

- Bankruptcy Lawyer

- Foreclosure Lawyer

- Negotiations & Settlements

- Credit Card Negotiations and Settlements

- Retention Options for Distressed Real Estate

- Tax Debt Negotiations and Settlements

- Student Loan Debt Negotiations

- Business Debt Negotiations and Settlements

- Medical Debt Negotiations

- Credit Repair

- Third-Party Short Sales and Voluntary Sales

- Deed in Lieu Agreements

- Cash for Keys Agreements

- Credit Card Reductions – Debt Reduction Lawyer for Credit Cards

- Consent to Judgment of Foreclosure and Sale Agreements

- Landlord-Tenant Negotiations and Settlements

- Mortgage Loan Modifications

- Credit Card Solutions

- Debtor litigation defense

- landlord Tenant Solutions

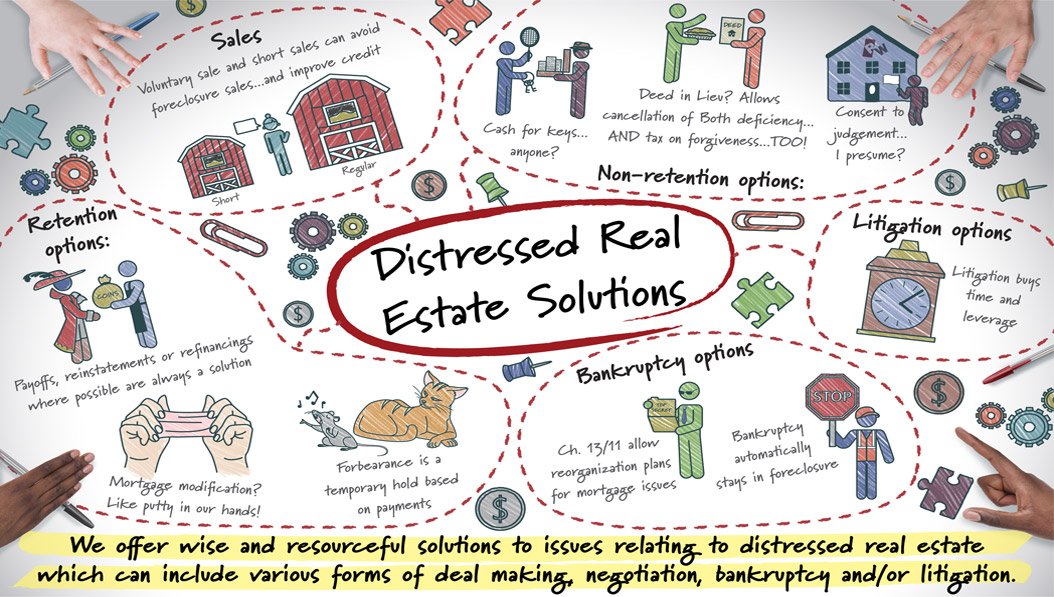

- Distressed Real Estate Solutions

- Student Loan Solutions

- Tax Debt Solutions

- Locations

- Hours

- Careers

- testimonials

- Blog

- faq’s

- contact