- Call for a Free Consultation, Near You. Hablamos Espanol

- Call for a Free Consultation, Near You. Hablamos Espanol

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout

- Long Island and New York, Since 1993.

-

SUFFOLK

(631)-271-3737,

QUEENS

(631)-271-3737,

QUEENS  (718)-751-0226

(718)-751-0226

-

NASSAU

(516)-307-0262,

BROOKLYN

(516)-307-0262,

BROOKLYN  (347)-508-9316,

BOHEMIA

(347)-508-9316,

BOHEMIA  (631)-223-4502

(631)-223-4502

- Exceptional Legal Representation Throughout Long Island and New York, Since 1993.

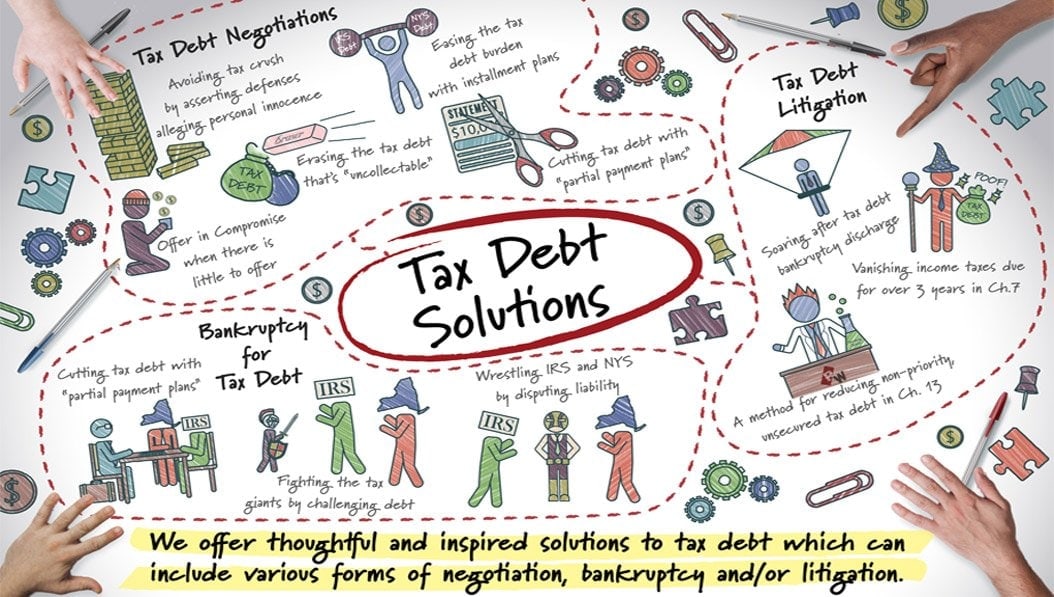

Tax Debt Solutions Long Island, NY

Navigate Your Way Out of Tax Debt

Discover tax debt solutions from Ronald D. Weiss, PC, offering pathways to resolve your IRS or state tax issues.

Focused Tax Law Knowledge

Our team concentrates on tax law, applying current knowledge to assist with your specific circumstances.

Personalized Resolution Plans

We listen to your situation and develop customized tax relief strategies that align with your financial position.

History of Client Assistance

We have assisted numerous Long Island residents and businesses in finding workable outcomes for tax difficulties.

Supportive Guidance Provided

You receive ongoing communication and clear explanations throughout the process of seeking tax debt solutions.

Tax Debt Relief Help Long Island, NYf

Your Ally for Addressing Complex Tax Problems on Long Island

Dealing with unpaid taxes often brings significant worry and can disrupt your daily life. At Ronald D. Weiss PC, we recognize the pressure tax liabilities create for individuals and businesses across Long Island. We offer structured tax debt solutions aimed at lessening that strain and helping you regain financial footing. Our approach involves understanding the specifics of your case, regardless of if it involves the IRS or New York State tax authorities.

Regardless of if you’re facing collection actions or simply fell behind, exploring tax debt solutions can be the first step toward resolving the matter effectively. Our purpose is to help you navigate these challenges and work toward a more stable financial situation.

Advantages Tax Help Long Island, NY

Move Toward Financial Stability

See how getting assistance with tax debt solutions can change your circumstances and reduce financial pressure.

Find relief from persistent communication from tax collection agencies trying to secure payment.

Reduce the anxiety associated with owing taxes by having knowledgeable assistance for your case.

Work toward lasting financial improvement with resolution strategies developed for your specific needs.

Protect your assets by addressing tax issues proactively to avoid actions like levies or liens.

Build a foundation for a better financial condition through strategic discussions with tax authorities.

Feel more in control as you actively pursue resolution for your tax liabilities with professional support.

Share details

Call us or get a free online consultation to help us identify your needs.

We'll follow up

If you requested an online consultation, you can expect a callback within 24-48 hours of your request.

The floor is yours

Connect with an expert and share all project specifics.

Planning

Like what you hear? We'll provide next steps and expert guidance.

Understanding Tax Debt Issues Long Island, NY

The Importance of Addressing Tax Debt

Ignoring tax debt rarely makes it disappear; in fact, penalties and interest can cause the amount owed to grow substantially over time. Actions like wage garnishments or bank levies can significantly impact your financial stability and daily life. Therefore, addressing unpaid taxes promptly is generally advisable. At Ronald D. Weiss PC, our team possesses a strong grasp of federal and New York tax regulations. We can help you understand the notices you receive and the potential consequences you might face.

Because of this, we prioritize clear communication, explaining the complexities of your situation in understandable terms. We review your financial details and tax history to identify appropriate tax debt solutions. Allowing tax problems to linger can create larger issues down the road. Taking the step to consult with a tax professional gives you clarity on your options and offers a way forward. We help Long Island residents find suitable paths to manage their tax obligations.

Tax Resolution Strategies Available Long Island, NY

Finding the Right Path for Your Tax Situation

Every person’s or business’s tax scenario has distinct elements. As a result, a one-size-fits-all solution is often inadequate. Having guidance familiar with the specific tax landscape on Long Island can be very beneficial. The attorneys at Ronald D. Weiss PC are acquainted with navigating IRS procedures as well as New York State tax matters. This familiarity helps in developing practical tax debt solutions.

We help if it involves:

- Negotiating Payment Plans

- Exploring Settlement Options (ex: Offer in Compromise)

- Addressing Unfiled Returns

Our objective is to give you the understanding and tools needed to maintain good standing with tax authorities moving forward. By addressing the root causes and establishing manageable agreements, you can work toward regaining financial control. If you are uncertain about how to handle your tax liabilities, reaching out for professional assessment is a positive step.

Hear from Our Clients

FAQs

What kinds of tax problems do your tax debt solutions address?

Our tax debt solutions cover various issues, including unpaid income tax, payroll tax problems, unfiled returns, IRS audits, and state tax disputes for Long Island residents and businesses.

How long does it usually take to resolve tax debt issues?

Resolution times vary greatly depending on the complexity of the case and the responsiveness of the tax authorities. We work diligently to move the process forward efficiently.

Is it possible to negotiate a lower settlement amount with the IRS?

Yes, programs like the Offer in Compromise allow some taxpayers to resolve their debt for less than the full amount owed, based on specific financial criteria and circumstances.

What happens during the initial consultation with your firm?

During the first meeting, we review your tax documents, discuss your financial situation, answer your questions, and outline potential pathways for addressing your tax debt solutions.

How much do tax debt resolution services typically cost?

Costs depend on the specific services needed and the complexity of your case. We provide clear information on our fee structure after understanding your situation during the consultation.

Can you help stop IRS collection actions like wage garnishment?

Yes, upon engagement, we can often communicate with the IRS or NY State to negotiate a hold on collection activities while working toward one of the available tax debt solutions.

- home

- About

- Scholarship

- services

- Bankruptcy Lawyer

- Foreclosure Lawyer

- Negotiations & Settlements

- Credit Card Negotiations and Settlements

- Retention Options for Distressed Real Estate

- Tax Debt Negotiations and Settlements

- Student Loan Debt Negotiations

- Business Debt Negotiations and Settlements

- Medical Debt Negotiations

- Credit Repair

- Third-Party Short Sales and Voluntary Sales

- Deed in Lieu Agreements

- Cash for Keys Agreements

- Credit Card Reductions – Debt Reduction Lawyer for Credit Cards

- Consent to Judgment of Foreclosure and Sale Agreements

- Landlord-Tenant Negotiations and Settlements

- Mortgage Loan Modifications

- Credit Card Solutions

- Debtor litigation defense

- landlord Tenant Solutions

- Distressed Real Estate Solutions

- Student Loan Solutions

- Tax Debt Solutions

- Locations

- Hours

- Careers

- testimonials

- Blog

- faq’s

- contact